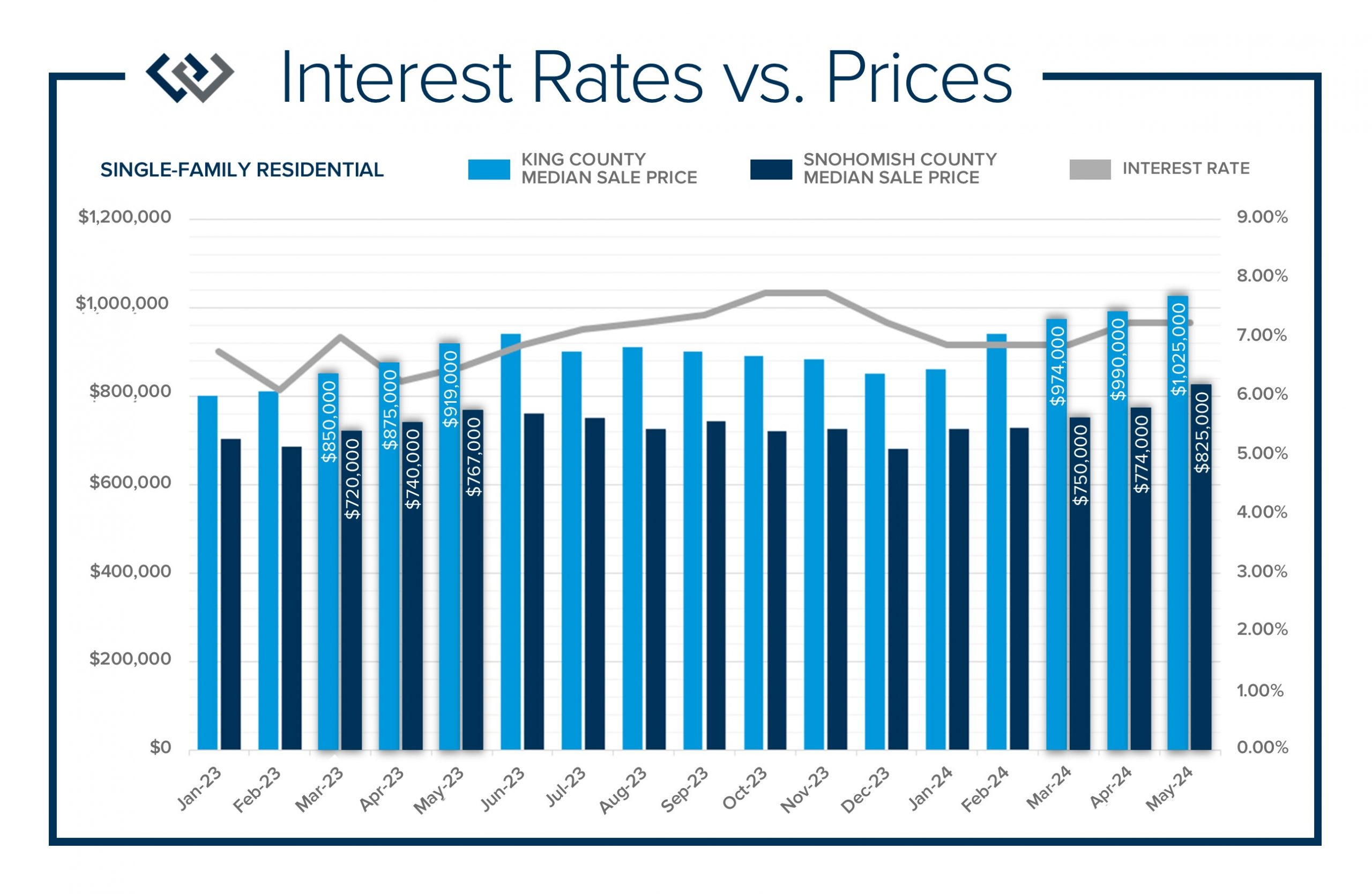

As we approach the mid-point of the year, we want to take a moment to explain all that has happened in the 2024 real estate market and where we might be headed. We have had strong price growth since December 2023, and in May 2024 prices matched the peak we saw in spring 2022. The interest rate increase and inflation-induced correction that took place in the spring of 2022 has shown very strong signs of recovery and stabilization. The chart below shows the last 17 months of median prices in both King and Snohomish Counties and also tracks the ebb and flow of interest rates.

Despite interest rates fluctuating between 6.75-7.5% from January through May 2024, price growth has been on an upward trajectory. Most recently, rates have hovered close to 7%. Inventory started the year very low! In King County, there were only 1,324 new listings in January and 534 in Snohomish County. This trend continued throughout Q1 2024 and has started to increase in Q2. In May 2024 there were 3,245 new listings in King County and 1,272 in Snohomish County. That was a 145% increase in King County from January to May and 138% in Snohomish County. Markedly, there was a 27% jump in new listings from April 2024 to May 2024 in King County and 34% in Snohomish County.

Adequate selection for buyers was limited, which drove prices up over the past five months. Buyers are starting to see some relief! There is healthy net in-migration into the Greater Seattle area, a stable job market, and the Millennial generation is out in force making their first purchases and some even moving up from their first homes. Since December 2023, the median price in King and Snohomish Counties has increased by 21%. One must take seasonality into account which elevates that growth, but there has certainly been a recovery in home values in the correction. Sellers are sitting on tons of equity as it was measured in November 2023 that homeowners in King County had at least 60% home equity and 57.5% in Snohomish County. This figure does not take into account the price growth we have seen in 2024 thus far.

So, what does all of this mean going forward? We typically will reach our seasonal peak in prices in May or June. This phenomenon is a result of price growth decelerating due to inventory growth over the second half of the year. The rate of price growth will slow as more homes come to market; this is not price depreciation, but deceleration. Homeowners are standing on the shoulders of immense growth over the last 5 months and need to keep that and the long-term growth in perspective. If the rapid rate of price growth continued, it would not be sustainable and would create market volatility. Moderation and price stability benefit the overall health of the real estate market and economy over prolonged extreme price increases.

As we head into the summer months, we anticipate more selection for buyers which will temper price growth. Sellers will enjoy the gains that have been made over the last 2 years and so far in 2024, not to mention the last 10 years. The recent increase in inventory has given buyers more opportunities to make a move. The constriction we started the year off with was restrictive for some buyers to enter the market and we see that changing. Buyers who were discouraged earlier this year may consider re-engaging so they can benefit from the increase in selection.

As far as interest rates, experts predict they will slowly recede and be dependent on inflation calming which has been stubborn. Affordability has been a dance of balancing home prices, rates, and monthly payments. Some buyers have been creative with rate buy-downs to manage the monthly expense, and some are purchasing based on today’s rates with the hope of re-financing in the future. A sound piece of advice for buyers is to buy based on payment, not on the peak of what you can qualify for. Your monthly output needs to be sustainable and somewhat comfortable to make sense.

Real estate is an investment and a key component to building wealth. While it might seem scary or risky to make a purchase, the long-term gains are favorable in comparison to other investment vehicles. Plus, you get to live in your home, love your home, and make memories in your home while it creates a nest egg. Life changes create reasons to move. Assessing where you want to be and how it matches your lifestyle is where the decision-making starts. If you have experienced some life changes and are curious about how the market relates to your housing goals, please reach out. It is our goal to help keep our clients informed and empower strong decisions.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link